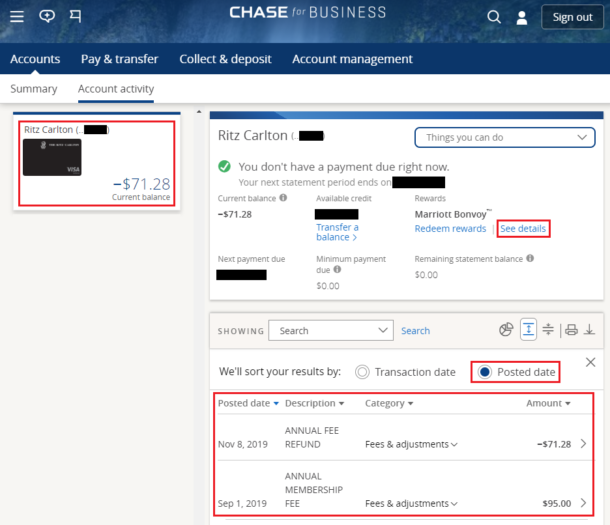

You are able to so it USDA qualification chart discover USDA-eligible belongings in your area. Look-up the brand new target you are interested in to acquire to verify they falls inside an outlying town, once the dependent on the fresh new U.S. Institution away from Farming.

USDA Mortgage Possessions Eligibility Conditions

Regardless if USDA loans are referred to as outlying property financing, it’s not necessary to are now living in the world otherwise pick farmland to use them. In fact, you will be surprised at how much cash of the nation is largely eligible for these types of fund.

According to Casing Direction Council, a whopping 97% off U.S. property is positioned within USDA-eligible borders. People elements allege regarding the 109 million Us citizens – or about a third of state’s whole people. *

Customers for the large locations and much more heavily populated suburbs are not qualified for those money, however, many residing in encompassing towns is. An area with a population from 35,one hundred thousand or smaller is deemed rural regarding USDA’s sight.

How to determine USDA possessions qualifications should be to research in the target regarding the map above. Simply kind of the house address for the product, push enter, and you’ll find out if the home is eligible for USDA investment. In the event the possessions appears inside the a shaded the main USDA qualifications chart, it is not currently qualified.

Property need to be situated in a good rural an element of the nation are entitled to USDA investment. To put this type of outlying section, brand new USDA factors within the an excellent community’s people, its distance so you can a major urban analytical urban area (MSA), and full access to financial borrowing from the bank in the area.

- It should don’t have any more than ten,000 citizens.

- In case your town has ten,001 so you’re able to 20,100000 people, it can’t be found inside a keen MSA. Around along with have to be a significant shortage of financial credit to possess low- and modest-income parents.

- If your area has actually 20,001 to help you thirty-five,000 residents, it must possess shortly after started felt outlying however, missing its reputation throughout the 1990, 2000, or 2010 Census. Once more, here in addition to need to be a significant insufficient home loan credit when you look at the the bedroom.

As you care able to see, there’s a lot you to definitely goes in determining a good city’s (and a beneficial property’s) USDA qualification. Observe qualified parts in your part, merely look a community address into the USDA assets qualification chart. One homes away from shady elements towards map is actually fair game.

Most other Possessions Qualifications Conditions

Opting for property during the a designated outlying city is just the first step to being qualified to have a beneficial USDA financing. That house will even need to be the majority of your residence – not a financial investment otherwise money-getting property.

- Features useful heating and cooling systems

- Promote easy accessibility of a flat or all the-environment road

- End up being structurally sound, that have a foundation that can last for no less than the life span of home loan

- Enjoys adequate roof

- Has actually a functional and you will working electric program without any frayed or established cables

- Bring working plumbing system and you will sufficient liquid tension to be sure spend removal

Once you have applied for the loan, your own USDA lender will be sending out a keen appraiser to evaluate the latest residence’s worthy of and you will condition and make certain the home fits most of the more than requirements.

Why USDA Money?

USDA qualified home open the doorway to countless gurus. For 1, USDA money need no advance payment, which can make buying a home way more reasonable upfront.

They likewise have down rates than many other loan applications, as well as their be certain that commission – the latest USDA’s loans in Murray method of home loan insurance policies – try cheaper than toward other mortgages also.

Fundamentally, USDA loans also provide lax credit requirements versus of many financial mortgage options. That will help you be eligible for the loan inside the the initial lay.

What exactly is Next?

After you have utilized the USDA financing chart to decide in the event the an excellent house is qualified, your following step will be to establish your meet income requirements. The quantity you can make to possess use of USDA fund is restricted and you will may vary by venue and you may home size, thus use this device for lots more specific information.

Once you have confirmed eligibility on the each other factors, it is time to make an application for preapproval that have an excellent USDA-accepted financial. Then you can through the preapproval page with your offer, that will make it easier to stand out from most other customers.

The bottom line

Leverage a USDA property qualification chart is only the first rung on the ladder if you’d like to make use of these rewarding financing on the homebuying trip. Need a great deal more help purchasing a home which have a good USDA loan? Get in touch with Neighbors Financial today. The USDA-approved financing officials try right here to guide you.