For only proprietorships and you can partnerships, you will also must render a beneficial T1 Standard tax go back for the past 24 months otherwise audited monetary statements otherwise a beneficial organization licenses otherwise your own GST/HST come back conclusion.

Getting corporations, you must promote either your audited monetary comments into the prior a couple of years or your posts regarding incorporation.

Sagen’s worry about-functioning home loan premium is actually notably greater than CMHC insurance premiums for antique mortgage loans. Having a premium rates of five.85% getting a deposit away from less than 15%, a good $500,000 home loan costs $31,250.

Canada Guarantee – Lowest Doctor Virtue

- Restrict LTV/Lowest Down payment: You might obtain to good ninety% loan-to-worthy of (LTV), otherwise generate a down-payment as low as 10%.

- Limit Loan amount: In Toronto, Vancouver, and you may Calgary, you might use up to $750,one hundred thousand. Regarding the rest of Canada, you could potentially use as much as $600,one hundred thousand. The maximum worth of is actually $1,one hundred thousand,100000.

- Minimum Credit score: You will need to possess a strong credit rating and you will credit background.

- Restriction Personal debt Services Ratios: The maximum GDS is actually 39% and limit TDS was 44%.

- Restrict Amortization Several months: 25 years

Canada Guaranty’s qualifications are like Sagen. You’ll want become thinking-used in no less than a couple of years, you simply can’t get on percentage transformation earnings, you have not defaulted into home financing or experienced bankruptcy regarding the past 5 years, together with assets must be owner-focused on to a few products.

Additionally you you should never use the advance payment. About 5% deposit should be from your resources, while the other individuals will be gifted.

Unlike Sagen, its not necessary to incorporate files such as for example audited financial comments or organization certificates. As an alternative, you will have to promote their latest Notice regarding Investigations.

FAQ About Notice-Employed Mortgages

That have financial standard insurance rates, you could potentially use as much as 95% of one’s value of your house. Versus insurance policies, you might simply acquire around 80% of worth of your house. An equivalent debt services proportion constraints apply at thinking-employed mortgage loans, and that to possess CMHC insurance might be 39% GDS (Gross Financial obligation Provider) and you may 44% TDS (Complete Financial obligation Services). This leads to the newest value of your financial, which relies on oneself-work income, almost every other earnings, along with your typical costs. In order to calculate how much cash you really can afford while the a personal-operating borrower, explore all of our financial value calculator.

Exactly https://paydayloancolorado.net/kiowa/ how many age do you have to be worry about-useful to rating home financing?

Regardless of if loan providers choose get a hold of at the very least 2 yrs out-of self-a career earnings, you can still score a home loan if you have been recently self-working. But not, mortgage loans getting has just mind-operating borrowers are much harder in order to qualify for and will wanted extra documents.

Ought i score a personal-operating mortgage as opposed to proof of money?

Sure, you should buy a self-working financial versus proof money. The sole home loan standard insurers that enable individuals locate good self-operating financial in the place of proof of income is Sagen and you may Canada Guaranty, that will be to have a reported income home loan. You will need to build a down payment with a minimum of ten% and you may obtain which have a lender that really works with these insurers. CMHC-insured mortgage loans need worry about-operating borrowers to show proof of money.

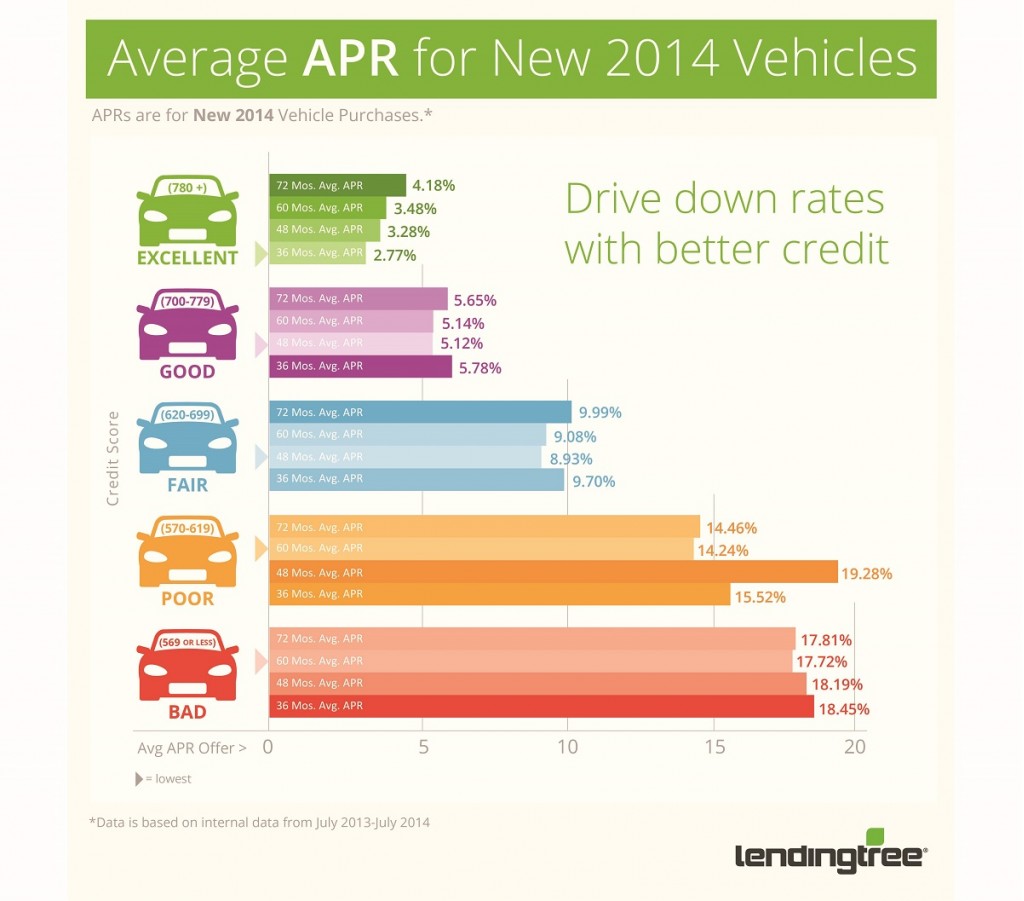

Try mortgage rates large to own care about-operating borrowers?

Self-employed home loan costs would be greater than normal mortgage loans, but there’s no fixed code one mind-operating pricing need to be large. As always, the better the money you owe, the more likely you can easily score a lesser financial rates. When you yourself have home loan default insurance rates on your own one-man shop home loan, their home loan rates is just as reasonable once the another insured mortgage.

To have incorporated worry about-employed some body, he is considered self-working if they’re employed by this business which they on their own own and earn a salary of it. Shareholders that aren’t group of one’s company and only found a bonus aren’t thinking-employed.

The brand new Terrible Personal debt Solution proportion is the part of your own month-to-month money necessary to shell out their monthly housing costs due to the fact Full Obligations Solution proportion ‘s the part of their month-to-month money requisite to expend all month-to-month living expenses (and additionally housing and you will non-property expenses).

Stated Income Mortgage loans

Whilst you won’t need to make sure your income, you still need to verify a brief history and you can operation of the organization and that it might have been functioning for around one or two years. You will need to bring a recent Find off Comparison that shows you have no income tax arrears.